Stonewell Bookkeeping Can Be Fun For Anyone

The Greatest Guide To Stonewell Bookkeeping

Table of Contents6 Easy Facts About Stonewell Bookkeeping ExplainedStonewell Bookkeeping Can Be Fun For AnyoneHow Stonewell Bookkeeping can Save You Time, Stress, and Money.The smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutStonewell Bookkeeping - An Overview

Most recently, it's the Making Tax Obligation Digital (MTD) campaign with which the federal government is expecting companies to conform. Bookkeeping. It's precisely what it says on the tin - services will certainly need to begin doing their taxes electronically through making use of applications and software program. In this case, you'll not just require to do your books however additionally use an app for it.You can rest easy understanding that your company' monetary info prepares to be examined without HMRC offering you any kind of anxiety. Your mind will be at simplicity and you can concentrate on other areas of your organization. It matters not if you're a complete novice or an accounting professional. Doing digital accounting offers you a lot of chances to find out and complete some knowledge spaces.

The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

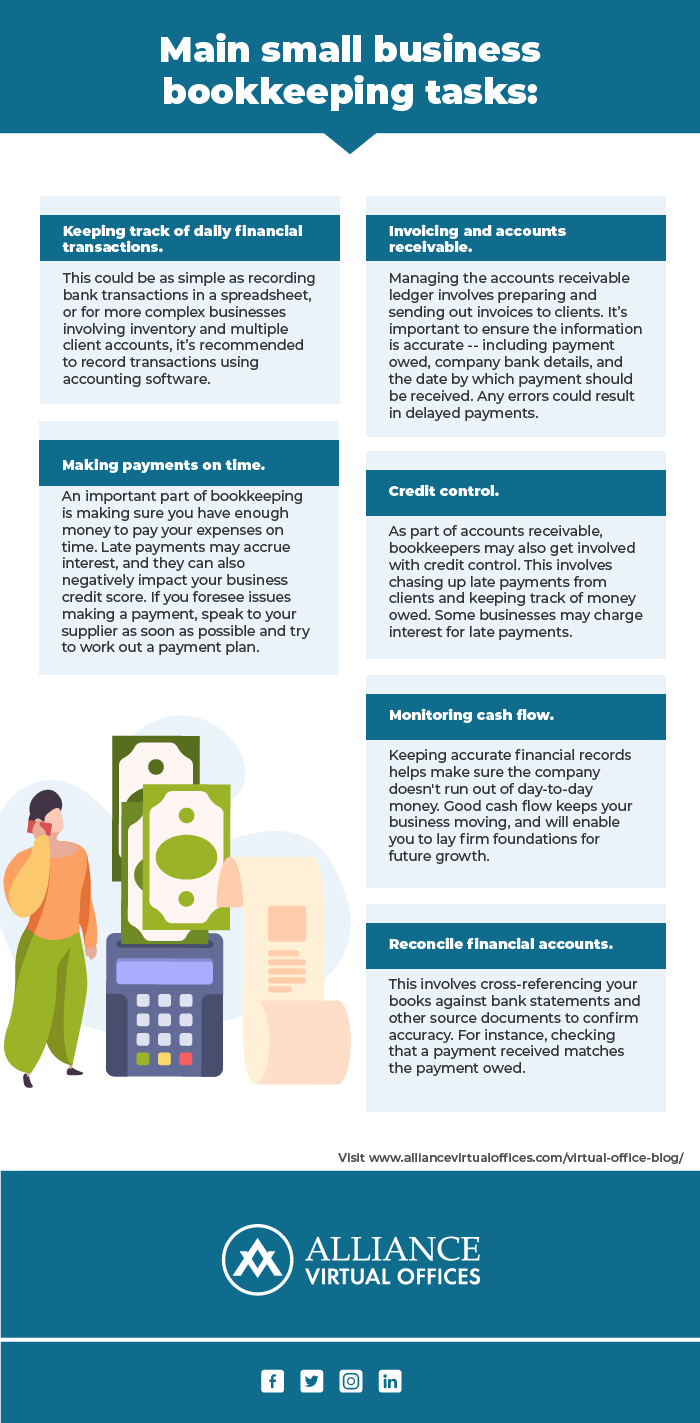

Accounting is essential for a small company as it helps: Monitor economic health and wellness and make informed choices, including cash money circulation. Adhere to tax policies and prevent fines. Track expenditures and incomes, making it possible for recognition of areas for enhancement. Enhance reliability with lending institutions, investors and customers. Mobile accountancy applications offer several advantages for little service proprietors and business owners, streamlining their economic monitoring jobs.

Many modern-day bookkeeping applications allow individuals to link their savings account straight and sync the transactions in genuine time. This makes it easier to check and track the earnings and expenditures of business, removing the demand for manual access. Automated features like invoicing, expenditure monitoring, and importing financial institution deals and financial institution feeds save time by reducing manual data access and simplifying accountancy procedures.

In addition, these apps reduce the requirement for working with additional personnel, as several tasks can be managed internal. By leveraging these advantages, small company proprietors can streamline their monetary monitoring processes, boost decision-making, and concentrate more on their core service procedures. Xero is a cloud-based accounting software that assists local business quickly handle their accounting records.

That "successful" client may really be costing you cash once you variable in all expenses. It's been haemorrhaging cash money for months, but you had no way of understanding.

4 Easy Facts About Stonewell Bookkeeping Shown

Here's where accounting comes to be truly interesting (yes, actually). Precise financial records give the roadmap for business development. small business bookkeeping services. Firms that outsource their accounting grow up to 30% faster than those handling their own books inside. Why? Since they're making decisions based upon strong data, not price quotes. Your bookkeeping discloses which services or items are really lucrative, which clients are worth keeping, and where you're investing unnecessarily.

Presently,, and in some capacity. But even if you can do something does not imply you should. Below's a functional comparison to help you decide: FactorDIY BookkeepingProfessional BookkeepingCostSoftware costs just (less costly upfront)Service charge (usually $500-2,000+ regular monthly)Time Investment5-20+ hours per monthMinimal evaluation reports onlyAccuracyHigher mistake danger without trainingProfessional precision and expertiseComplianceSelf-managed risk of missing out on requirementsGuaranteed ATO complianceGrowth PotentialLimited by your offered timeEnables concentrate on core businessTax OptimisationMay miss reductions and opportunitiesStrategic tax obligation planning includedScalabilityBecomes frustrating as organization growsEasily ranges with service needsPeace of MindConstant bother with accuracyProfessional guarantee If any of these noise acquainted, it's most likely time to bring in an expert: Your company is expanding and transactions are increasing Bookkeeping takes greater than five hours regular You're signed up for GST and lodging quarterly BAS You employ staff and take care of payroll You have multiple revenue streams or savings account Tax obligation season loads you with genuine dread You prefer to focus on your real imaginative work The truth?, and professional accountants understand exactly how to leverage these tools effectively.

Unknown Facts About Stonewell Bookkeeping

Perhaps particular jobs have much better payment patterns than others. You may uncover that particular advertising and marketing channels deliver remarkable ROI. These understandings enable you to double down on what jobs and eliminate what does not a dish for sped up, lasting growth. Even if selling your business appears remote, preserving tidy financial documents constructs venture value.

You might additionally pay too much taxes without proper documents of Discover More deductions, or face difficulties during audits. If you find mistakes, it's crucial to correct them immediately and amend any kind of damaged tax lodgements. This is where expert bookkeepers show indispensable they have systems to capture mistakes prior to they come to be pricey problems.

At its core, the primary difference is what they do with your monetary data: deal with the everyday tasks, including recording sales, expenses, and financial institution settlements, while keeping your basic copyright up to date and exact. It has to do with obtaining the numbers right constantly. step in to analyse: they consider those numbers, prepare financial declarations, and analyze what the data really indicates for your company growth, tax obligation placement, and earnings.

Not known Factual Statements About Stonewell Bookkeeping

Your company decisions are only as great as the documents you have on hand. Keeping precise records requires a lot of work, even for tiny services. Organization tax obligations are complicated, lengthy, and can be stressful when attempting to do them alone.